No Matter Your Account, It’s Full of Features

Keep as much or as little as you need.

There are no monthly or hidden service charges.

Enjoy convenient access to your funds anywhere Visa® is accepted.

Get what you need with online, mobile, and telephone banking.

Transfer from your savings account or personal line of credit.

Create the Right Experience for You

Find the account thats right for your lifestyle

Looking for the simple way to manage your money? A Simple Checking account is your solution! Simple Checking offers:

- No minimum balance

- No monthly service charges1

- Free Visa® debit card with purchase rewards

When you are looking for a little more from your checking account, choose High Yield Checking from SkyPoint. High Yield Checking’s features allow you to:

- Earn up to 4.0% APY2 on your balance.

- Get up to $20 in ATM fee refunds per month.1

- Receive a free Visa® debit card.

If earning cash back on your debit card purchases fits your lifestyle better, SkyPoint’s Cash Back Checking is where it’s at. Cash Back Checking features allow you to:

- Earn 2% cash back on qualifying debit card transactions.3

- Get up to $20 in ATM fee refunds per month.4

- Receive a free Visa® debit card.

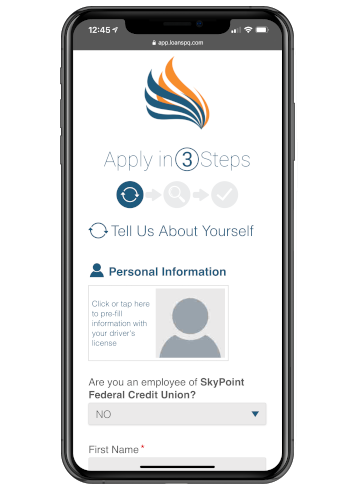

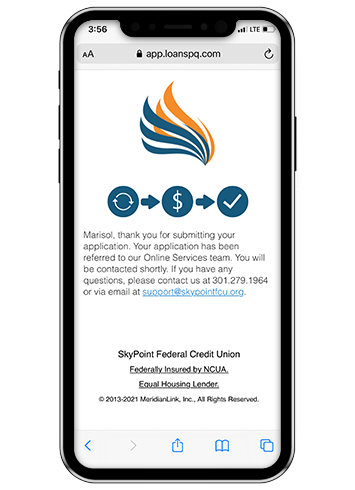

Get Started Today!

Open your new Checking account in minutes!

1There are certain fees that apply on an individual basis, such as the overdraft fee. See the Service Charge Schedule for details on the various charges SkyPoint may assess.

2APY is annual percentage yield. Members enrolled in SkyPoint High Yield Checking earn 4.0% APY on the first $20,000 in balances. Balances of $20,001+ earn 0.50% APY. Members must be enrolled in estatements, deposit at least $250 using ACH, and have at least 20 debit card transactions during the monthly period to qualify for the cash-back rebate.

3Members enrolled in SkyPoint Cash Back Checking earn 2% cash back rebate each month on all qualified debit card transactions during the month. Members must be enrolled in estatements, deposit or withdraw at least $250 using ACH, and have at least 20 debit card transactions during the monthly period to qualify for the cash-back rebate.

4Non-SkyPoint ATM fees will be reimbursed up to $20 per month for members enrolled in SkyPoint Cash Back or SkyPoint High Yield Checking when qualifications are met. Members must be enrolled in estatements, deposit at least $250 using ACH, and have at least 20 debit card transactions during the monthly period to qualify for ATM fee refunds.