Spend Smarter and Save More

SkyPoint Thrive student banking is here to make it simple.

Open nowCheck status

The Right Tools for School

SkyPoint has a full slate of tools to help you manage your finances during your school years.

No minimums or monthly fees. Only $5 to open.

Keep up-to-date on your balances and more.

Build your credit as a young adult.

Banking for the School Years Has Never Been Easier

Here’s how students use SkyPoint

A checking account is a great way to spend money easier with a debit card or pay your friends from the app!

- Spend smart and contactless with a free SkyPoint Visa Debit Card

- Deposit checks from your phone

- Instantly transfer funds anywhere

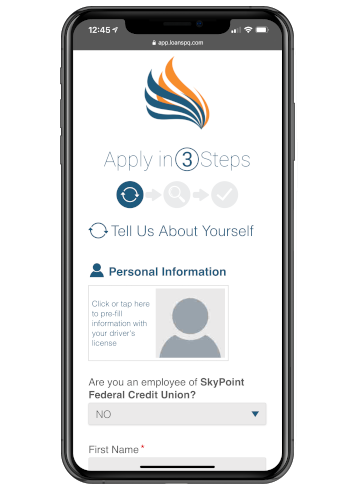

A Thrive Savings account will get you started with as little as $5.

- Open for only $5

- No minimums or monthly fees

- Get access to SkyPoint’s mobile app

Get up-to-date balances, deposit checks, and pay your friends back – all from SkyPoint’s mobile app.

- Pay your friends back wih peer-to-peer payments

- Turn your debit or credit card off if you lose it

- Track your spending and budget

- Keep track of your credit score for after graduation

Get the money you need for school.

- For students attending degree-granting institutions

- Lock in with competitive rates

- No prepayment penalty

When you need more flexibility for spending, a Visa Platinum Secured Credit Card is a great fit.

- Helps you build your credit score

- Credit line secured by funds in your SkyPoint Thrive Savings account

- No monthly fees

Learn all of the things about finances that they won’t teach you during class.

- Learn how to budget and save for a big senior trip or a car downpayment

- Get your credit score ready for after graduation

- Taxes!? Teagm you’ll have to do them some day. Learn what goes into them and be prepared.

Savings rates

| Product | Rate* | APY** |

|---|---|---|

| Regular Savings 1 | 0.05% | 0.05% |

| Special Savings | 0.05% | 0.05% |

| Summer Savings | 0.05% | 0.05% |

| Holiday Savings | 0.05% | 0.05% |

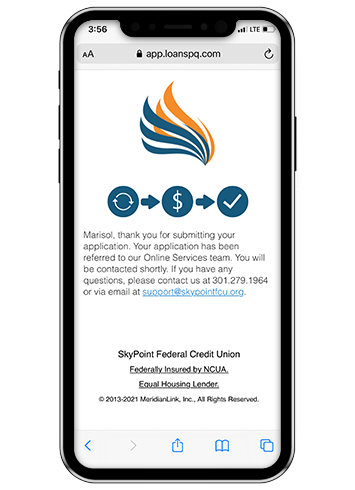

Get Started Today!

Open your Thrive Checking or Savings account in minutes!

1 Members with only a Regular Savings are subject to a minimum balance requirement. Failure to meet this requirement may result in a fee. Please refer to the Service Charge Schedule for more information. Limit of one Regular Savings per membership.

* Rate = Dividend Rate.

** APY=Annual percentage yield. Rates are subject to change without notice at any time. The stated APY is accurate as of 02/09/26. Fees may reduce earnings.